Have you ever felt stuck in a subscription you couldn’t cancel? Or wondered if your boss is allowed to see your pay? Maybe you’ve been told crossing the street at the wrong spot is always illegal, or that your broken phone can’t be fixed anywhere you choose. The legal rules surrounding these everyday situations are not what most people think they are.

Laws that touch your wallet, your job, and your freedom to move through the world change more often than you realize. Courts strike them down, agencies abandon enforcement, and what seemed clear last year might be gone tomorrow. Let’s dig into what actually applies right now in 2026.

Canceling Subscriptions Is Still a Legal Minefield

The Federal Trade Commission finalized a sweeping “click-to-cancel” rule back in October 2024 after receiving more than sixteen thousand public comments. People assumed companies would soon be required to let you cancel a subscription as easily as you signed up. That sounded like a win for anyone tired of hunting through maze-like websites or sitting on hold just to stop a monthly charge.

A federal appeals court vacated the FTC’s click-to-cancel rule in July 2025, citing procedural problems. The rule never took effect. Courts found the FTC had skipped a required cost analysis during the rulemaking process, so the entire regulation was tossed out before its planned mid-2025 enforcement date.

Right now, there is no federal click-to-cancel mandate. Companies are still subject to laws targeting negative option programs including the Restore Online Shoppers’ Confidence Act (ROSCA) and state autorenewal laws, as well as Section 5 of the FTC Act and analogous state unfair and deceptive trade practices laws. That means your ability to cancel easily depends on where you live and which state laws apply to your situation, not on a blanket federal rule.

Credit Card Late Fees Aren’t Capped at Eight Dollars

In March 2024, the CFPB adopted a lower threshold of eight dollars and ended automatic inflation adjustments for issuers with one million or more open accounts. The plan was to slash typical late fees from over thirty dollars down to eight bucks, saving American families billions. Consumer groups celebrated, and credit card companies immediately sued.

A federal judge vacated the CFPB’s eight-dollar late fee rule in April 2025. The new CFPB leadership under the Trump administration actually agreed with industry challengers that the cap violated the CARD Act by not allowing issuers to charge fees that were reasonable and proportional to the violation. The court tossed the rule entirely in a joint settlement with the plaintiffs.

Large credit card issuers (those with over one million open accounts) can still charge late fees exceeding thirty dollars under the old safe harbor amounts. If you miss a payment in 2026, expect the same penalties that existed before the attempted cap. The supposed savings never materialized.

Your Boss May Not Be a “Joint Employer” After All

Lots of gig workers, franchise employees, and contract staff believed a 2023 rule from the National Labor Relations Board would make it easier to hold parent companies and franchisors accountable as joint employers. Under the NLRB’s new standard, an entity could be considered a joint employer if it shared or codetermined essential employment terms, or even if it had indirect or reserved control it never actually exercised.

A US district court vacated the NLRB’s joint employer rule in March 2024. The judge ruled that the standard was unlawfully broad and would treat virtually every contractor relationship as joint employment. The NLRB later dropped its appeal in mid-2024, effectively accepting defeat.

The 2020 joint employer rule is back in force now, which requires a company to actually exercise substantial, direct, and immediate control over workers to be deemed a joint employer. Reserved or indirect influence is not enough. Many workers assumed broader protections were in place; that assumption is flat wrong.

Noncompete Agreements Are Still Legal and Enforceable

In April 2024, the FTC announced a rule banning noncompetes, but the rule is not in effect and it is not enforceable because a district court issued an order stopping the FTC from enforcing the rule on August 20, 2024, and the FTC appealed that decision. Media coverage suggested millions of American workers were about to be freed from restrictive job agreements. The reality turned out differently.

The Texas federal court held that the FTC exceeded its statutory authority and acted arbitrarily in trying to impose a blanket ban. Unlike the preliminary injunction, which was specific to plaintiffs, the ruling prevents the FTC from enforcing the rule against any company nationwide. Later reporting noted that the government eventually stopped defending the ban in court altogether.

Noncompetes remain a widespread practice, forcing workers to either stay in a job they want to leave or bear significant harms and costs such as switching to a lower-paying field or relocating. Over twenty percent of US workers are still bound by these agreements, and state law determines whether your noncompete can be enforced, not any federal rule.

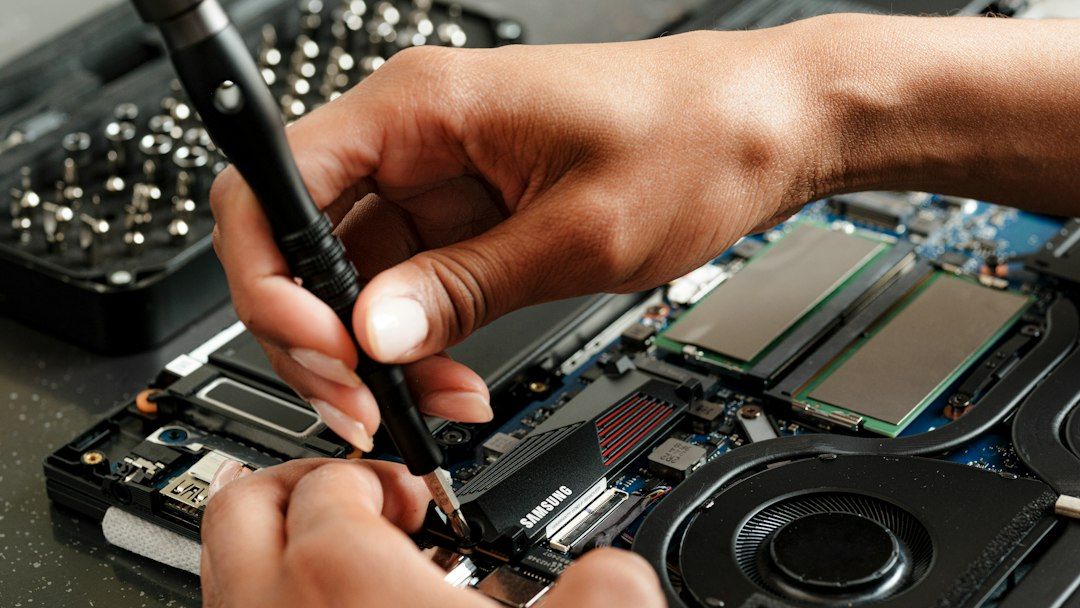

You Can Fix Your Own Electronics in California

California’s Right to Repair law (SB 244) became operative on July 1, 2024. This one actually did take effect. The legislation mandates that manufacturers of electronic and appliance products provide consumers and independent repair providers with access to necessary parts, tools, and documentation on fair and reasonable terms.

Let’s be real: most people assumed manufacturers could restrict repairs to their own authorized shops forever. SB 244 changed that. For products with a wholesale price between fifty and ninety-nine dollars, manufacturers must provide repair materials for at least three years after the last manufacturing date; for products costing one hundred dollars or more, manufacturers must provide repair materials for at least seven years.

This is a rare example of a consumer protection rule that survived and is enforceable today. If you live in California and own an expensive appliance or smartphone, you have a legal right to get parts and repair manuals, not just empty promises. Other states have not followed suit on this scale yet, so your mileage varies depending on location.

Gig Workers May or May Not Be Employees

The classification of gig workers as independent contractors versus employees is one of the most confused areas in employment law today. California’s AB5 law, which went into effect in 2020, attempted to reclassify many gig workers as employees using an “ABC test.” Then Proposition 22 carved out exemptions for app-based drivers. Courts have been battling over the details ever since.

Meanwhile, the US Department of Labor issued guidance under the Biden administration that made it easier to find worker misclassification, then the Trump administration began rolling back those interpretations. If you drive for a rideshare company or deliver food, your legal status as an employee or contractor depends on a shifting patchwork of state laws, federal guidance, and ongoing litigation.

People think they know where they stand. They don’t. The same job could make you an employee entitled to minimum wage and benefits in one state, and a contractor with no protections in another. Even within one state, court rulings can flip the answer overnight.

Medical Debt and Credit Reporting Rules Have Changed

For years, medical debt could tank your credit score just like unpaid credit card bills. Consumer advocates fought to change that. In 2022, the three major credit bureaus announced they would remove medical debts under five hundred dollars from credit reports and extend the waiting period before reporting unpaid medical bills from six months to one year.

Further changes came in 2023 when the CFPB proposed a rule to remove medical debt from credit reports entirely. As of early 2026, some medical collections have indeed disappeared from credit files, but the full rule has faced delays and legal challenges. Many consumers still believe all medical debt will wreck their credit forever, or conversely, that it’s been fully erased. Both beliefs are wrong.

The safest assumption is that large medical debts can still hurt your credit, but smaller amounts and newer bills might not show up. Check your credit report rather than guessing. This is an area where outdated folk wisdom spreads faster than the actual policy updates.

What Does This All Mean for You

Laws that seemed locked in just a few years ago have been overturned, blocked, or abandoned. The click-to-cancel rule never launched. The eight-dollar late fee cap was scrapped. The FTC’s noncompete ban died in court. These weren’t small tweaks; they were entire regulatory frameworks that vanished before taking effect. If you planned your finances or job search around them, you were planning around air.

At the same time, some protections did arrive. California’s right to repair law is real. Pay transparency rules are spreading state by state. Medical debt reporting has shifted, even if not as much as headlines suggested. The lesson is simple: verify what’s actually in force right now, not what was announced or proposed.

It’s hard to say for sure, but keeping up with legal changes might be more important than ever. Courts and agencies are rewriting the rules in real time, and what you learned even a year ago could be completely outdated. What law have you been misunderstanding all this time?