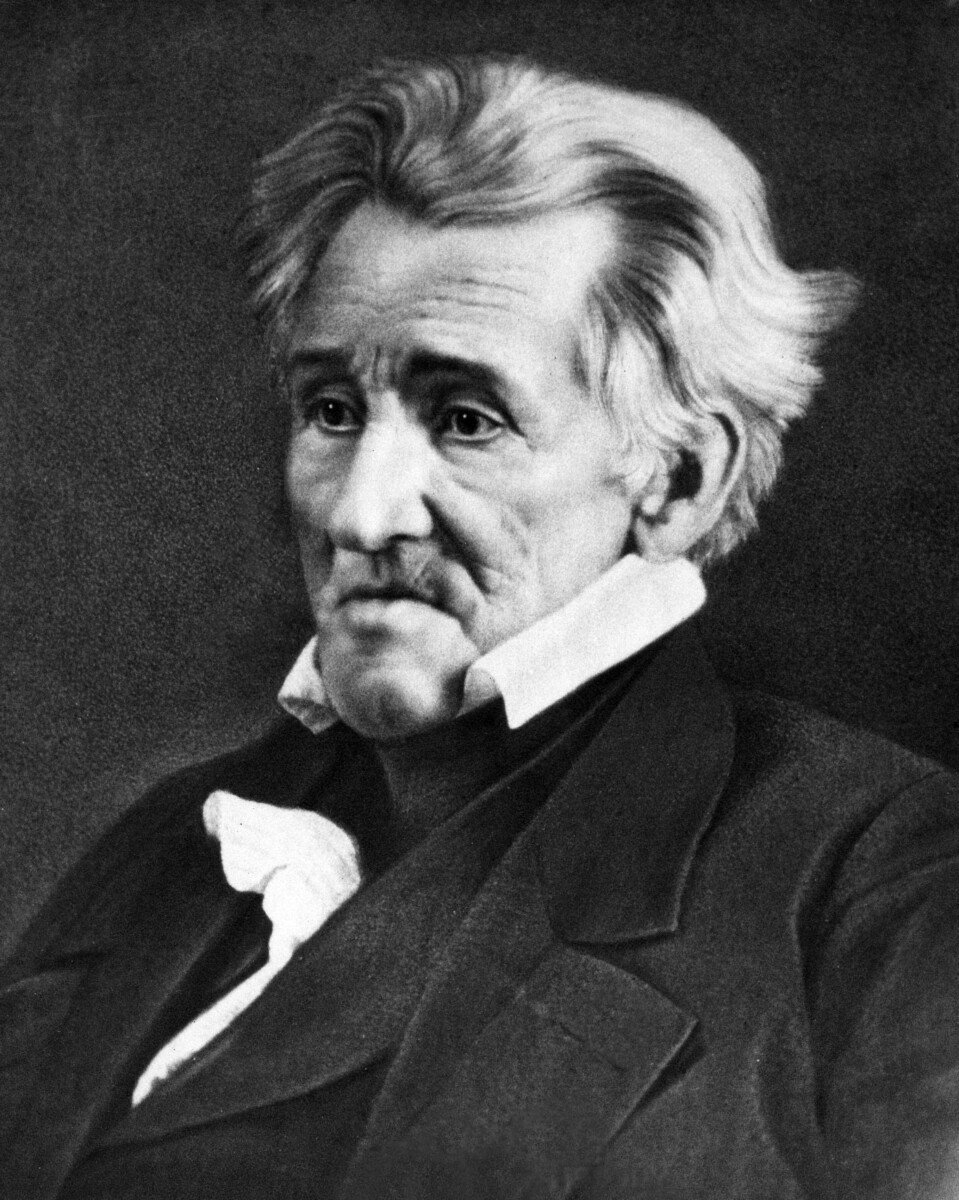

Jackson’s Populist Crusade Against Elite Power

The year 1832 changed everything. When President Andrew Jackson vetoed the bill rechartering the Second Bank of the United States in July 1832, he wasn’t just making a financial decision – he was declaring war on what he saw as a corrupt institution that favored the wealthy elite over ordinary Americans. Jackson characterized the bank as hopelessly corrupt and argued that “the powers conferred upon [the bank were] … not only unnecessary, but dangerous to the Government and the country.” This moment marked the beginning of America’s first great populist uprising against financial institutions.

Jackson thought the Bank put too much power in the hands of too few wealthy American private citizens, and the majority of stockholders were foreign investors with allegiances to other governments. His stance wasn’t just about economics – it was about American sovereignty and democratic values. The president believed that concentrated financial power threatened the very foundation of the republic.

The Bank’s Immense Power and Controversial Role

The Second Bank of the United States opened in 1817 to conduct business mainly as a private corporation, with BUS notes backed by the country’s substantial gold reserves, providing a more stable national currency. This institution wielded unprecedented financial influence across the young nation. By managing its lending policies and the flow of funds through its accounts, the Bank altered the supply of money and credit, as well as the interest rates charged to borrowers.

The Bank’s power extended far beyond simple banking operations. With a capital of $35 million—a staggering sum for its time—the Second Bank of the United States made it one of the nation’s largest financial entities, serving as the federal government’s fiscal agent and holding significant regulatory authority over state banks. For many Americans, this concentration of financial control felt more like monarchy than democracy.

Foreign Influence and National Security Concerns

Much of the Bank’s stock was held abroad, especially in Britain, though the charter screened management from foreign interference by barring noncitizens from serving as directors or voting their shares. Yet Jackson saw this foreign investment as a threat to American independence. Bank dividends siphoned off American money overseas, and Jackson warned that “If we must have a bank, it should be purely American.”

These concerns about foreign control weren’t merely theoretical. The United States was still a young nation, having fought Britain twice within living memory. The idea that foreign investors could profit from American financial policies struck many as fundamentally wrong, regardless of constitutional safeguards.

Political Warfare and the Birth of Modern Parties

Jackson won reelection with over four times as many electoral votes as his opponent Henry Clay, with economist Eric Hilt noting that “Jackson staked his whole reelection campaign on destroying the bank, and his victory is a sign that sufficient numbers of Americans shared his fear and skepticism of the institution.” This victory represented more than a personal triumph – it was a mandate for economic populism.

Jackson’s veto became the touchstone issue in his reelection campaign and precipitated the organization of the Whig and Democratic parties, with the very language of Jackson’s veto providing “a political grammar since claimed by Populists, Progressives, New Deal liberals, socialists, free marketeers, libertarians—in short, by just about everybody.” The Bank War literally created America’s modern political party system.

Economic Chaos Following the Bank’s Destruction

Shortly after Jackson’s reelection, he ordered that federal deposits be removed from the Second Bank and placed in state banks, with most of the government’s money moved out by late 1833, causing the Bank to shrink in both size and influence. The consequences were swift and severe. Bank president Nicholas Biddle restricted loans and tightened the nation’s money supply, but this plan backfired and inspired greater suspicion of the Bank’s power.

The economic consequences of the Bank’s dissolution were severe, with the process of removing federal deposits proving disastrous as competition between “pet” state banks reignited problems of exchange rates and inflation that had plagued American money before the Bank’s reestablishment. The nation learned harsh lessons about the risks of dismantling financial institutions without proper replacements.

Decades Without a Central Bank

It would be more than seventy-five years before the United States made another attempt to establish a central bank, during which period the U.S. economy experienced several banking crises, culminating in the Panic of 1907 which triggered a nationwide suspension of payments and deep recession. This long period of financial instability demonstrated the dangers of operating without effective monetary control.

In a lengthy battle over a national banking system, President Andrew Jackson reshaped the American economy to run without a central bank until the Federal Reserve was created in 1913, strengthening the Executive branch’s role in ways that reverberate today. Jackson’s actions established precedents for presidential power that continue to influence American politics.

The Federal Reserve’s Complex Legacy

Although the aggressive means by which the Second Bank was dismantled led to system-wide financial failure and recession in the short term, the long-run outcome was likely a wider diffusion of banking services and more efficient capital allocation, with “The Federal Reserve benefited from applying a more rigorous regulatory structure onto the grid that the populists, free bankers, and National Banking System established.”

The Federal Reserve, established in 1913, represented a compromise between Jacksonian democracy and financial necessity. It created a decentralized system with regional banks while maintaining central coordination – attempting to balance local control with national stability in ways the Second Bank never achieved.

Modern Banking Crises Echo Jackson’s Era

In March 2023, the US banking sector turmoil sent shockwaves through the global financial system when Silicon Valley Bank collapsed in a matter of days, followed by Signature Bank and First Republic Bank, marking the largest bank failures after Washington Mutual Bank in 2008. These failures revealed striking parallels to Jackson’s concerns about concentrated risk and inadequate oversight.

Silicon Valley Bank relied on a deposit base with 90 percent uninsured deposits, invested in long-term government securities, and had expanded rapidly, tripling in size in the preceding two years. Like the Second Bank, SVB’s concentrated customer base and risky practices made it vulnerable to sudden collapse, demonstrating that Jackson’s fears about institutional concentration remain relevant.

Contemporary Federal Reserve Challenges

The Federal Reserve has unique responsibility for banking crises from its multiple roles as conductor of monetary policy, financial stability regulator, lender of last resort, bank supervisor, and payment system regulator, with the spring 2023 banking crisis showing that “the Fed’s current implementation of these roles causes substantial contradictions and problems resulting in unnecessary financial instability and bailouts of creditors.”

President Donald Trump has lobbied for the Fed to cut rates to boost economic growth, but Fed policymakers have been reluctant, with Fed Chair Jerome Powell noting that “It takes some time for tariffs to work their way through the chain of distribution to the end consumer.” These tensions between political pressure and monetary independence echo Jackson’s conflict with the Second Bank.

Populist Echoes in Modern Politics

Jackson’s populist brand of politics, fueled by distrust of elites and conviction that federal power should benefit the everyday citizen, created lasting political templates. Today’s political movements, from both left and right, often invoke Jackson’s language about fighting corrupt elites and protecting ordinary Americans from powerful institutions.

When main financial regulators or stabilizing forces are abruptly dismantled, markets lose their anchor, with modern parallels including “sudden changes to Federal Reserve independence or major regulatory frameworks.” The lessons from Jackson’s era remain remarkably relevant for contemporary debates about financial regulation and institutional power.

Banking Supervision Lessons from History

In 2024, bank regulators were still operating under the shadow of the 2023 bank failures, particularly Silicon Valley Bank, whose risks including “interest rate and funding risks, rapid growth, and the idiosyncratic business model” exposed “significant flaws not only in the bank’s management but also in the approach to oversight and supervision.”

The 2023 failures of Signature Bank and Silicon Valley Bank raised questions about bank supervision, including whether banking regulators are adequately escalating supervisory concerns, with bank failures raising questions about federal regulators’ ability to promptly address unsafe banking practices. These supervisory challenges mirror the oversight problems that plagued the Second Bank during Jackson’s time.

The Bank War of 1832 established enduring patterns in American politics and finance that continue shaping our world today. Jackson’s populist crusade against concentrated financial power created the template for modern political movements, while the economic chaos following the Bank’s destruction demonstrated the dangers of dismantling institutions without proper replacements. As we face new banking crises and debates about Federal Reserve independence, Andrew Jackson’s war against America’s first central bank offers both warnings and wisdom for navigating the complex relationship between democratic governance and financial stability. What would Jackson make of today’s too-big-to-fail banks?