Understanding the intricate world of tariffs can be like trying to navigate a complex puzzle. As pieces of this puzzle, tariffs have been a staple in the U.S. trade strategy, particularly in recent years. The goal? To shield domestic industries from foreign competitors by imposing taxes on imports, making them pricier. But what happens when we look beyond the immediate effects? This article delves into the long-term economic impacts of these policies, shedding light on both the benefits and the potential pitfalls they bring.

Understanding Tariffs

Tariffs, often considered the guardians of domestic industries, are taxes placed on imported goods. They can be seen in two primary forms: ad valorem tariffs, which are a percentage of the product’s value, and specific tariffs, which are a fixed fee per unit. The main aim is to nudge consumers towards home-grown products over foreign ones. However, this goal is not without controversy. Economists often debate the efficiency of tariffs in genuinely protecting domestic markets. It’s like trying to decide if a heavy winter coat is necessary for a mild autumn day—some say yes, others disagree.

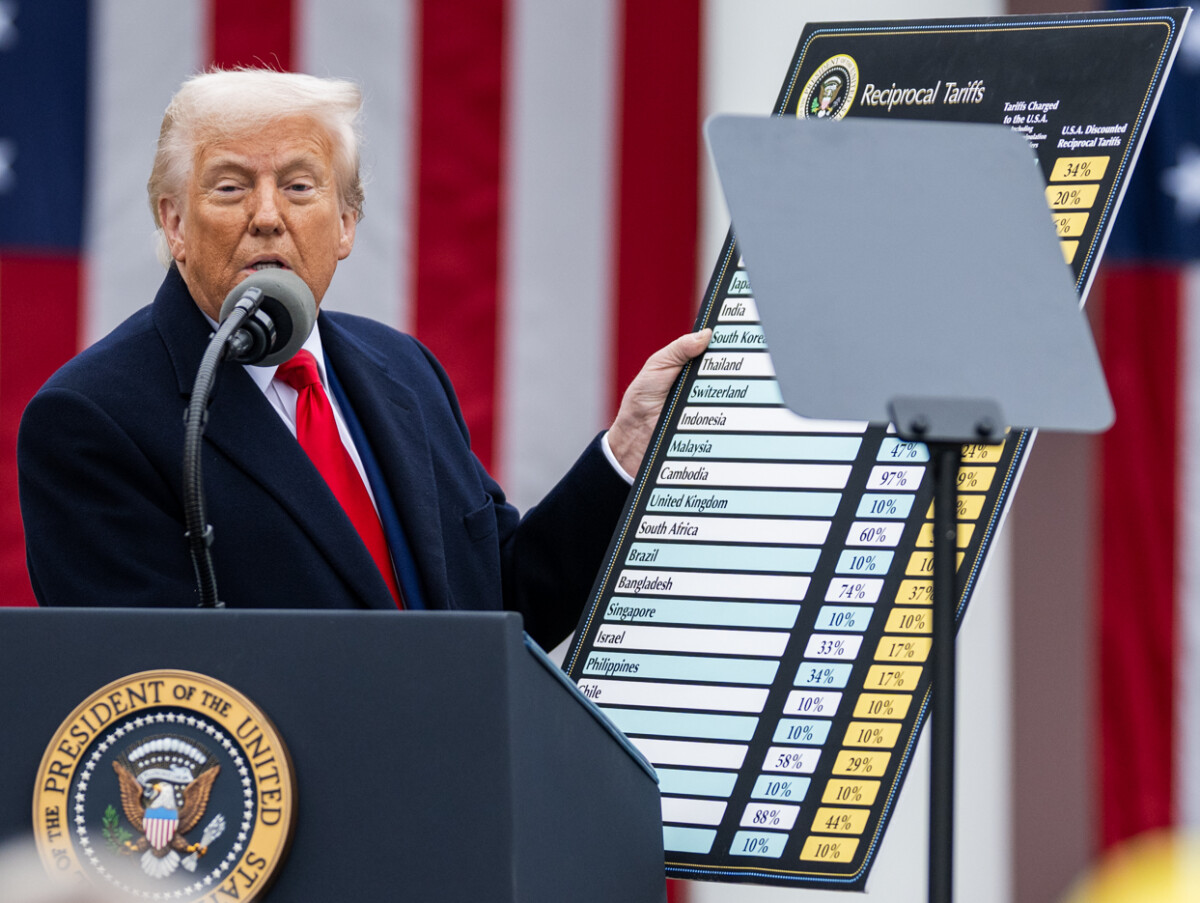

The Rationale Behind Current Tariff Policies

The U.S. has recently adopted a more protectionist approach, aiming to safeguard American jobs and industries from the looming shadow of foreign competition. The argument is simple: by implementing tariffs, domestic manufacturers get a fair shot against cheaper imports. This strategy hopes to boost local production and, ideally, lead to job creation. However, this is akin to putting all your eggs in one basket. While the basket might seem secure now, its durability over time remains uncertain.

Short-Term vs. Long-Term Effects

While tariffs can offer a short-lived sigh of relief to certain sectors, their long-term implications are more intricate. In the immediate aftermath, consumers might face higher prices, and trading partners could retaliate with their own tariffs. Over time, domestic industries might become complacent, relying more on protection than on innovation. It’s like a student who relies on cheat sheets—effective in the short run but detrimental in the long haul when genuine understanding is required.

Impact on Consumers

For consumers, the long-term effects of tariffs can be particularly challenging. Higher taxes on imports often translate to increased prices for everyday items. This means that the average consumer’s purchasing power might dwindle, forcing them to pay more for less. Moreover, with fewer foreign products available, consumer choice narrows, leading to a monotonous market landscape. It’s like walking into an ice cream parlor only to find just two flavors—vanilla and chocolate—when you were hoping for a myriad of choices.

Effects on Domestic Industries

While tariffs aim to be a protective shield for domestic industries, they can sometimes act as a double-edged sword. Industries dependent on imported raw materials might see their costs spike, leading to pricier production processes. This can result in job losses in sectors not directly under the tariff umbrella. Moreover, without the pressure of foreign competition, companies might lose their innovative edge, becoming less competitive on the global stage. It’s reminiscent of an athlete who stops training hard because there are no competitors in sight.

Trade Relationships and Retaliation

Tariff policies can put a strain on international trade relationships. Countries affected by U.S. tariffs might retaliate, creating a tit-for-tat scenario that can escalate into a trade war. Such conflicts can disrupt global supply chains and foster uncertainty in international markets. The long-term effects of these strained relationships can pose challenges to economic growth and global collaboration. It’s like two neighbors building fences higher and higher, each trying to outdo the other, only to find they’ve blocked out the sun.

Economic Growth and GDP

The long-term influence of tariffs on the U.S. GDP is a significant concern. While certain industries might flourish initially, the broader impact on economic growth can be stifling. With increased prices and reduced consumer spending, the economy might experience a slowdown. Furthermore, tariffs can deter foreign investment, as investors might shy away from a market with unpredictable trade policies. It’s akin to a garden that, without proper care and attention, sees its growth stunted over time.

Conclusion

In sum, the long-term economic impact of current U.S. tariff policies presents a complex tapestry of outcomes. While the intention is to bolster domestic industries and safeguard jobs, the ripple effects can prove challenging for consumers, industries, and international trade relations alike. As the world economy continues to evolve, policymakers must weigh these broader implications carefully to ensure sustainable economic growth.