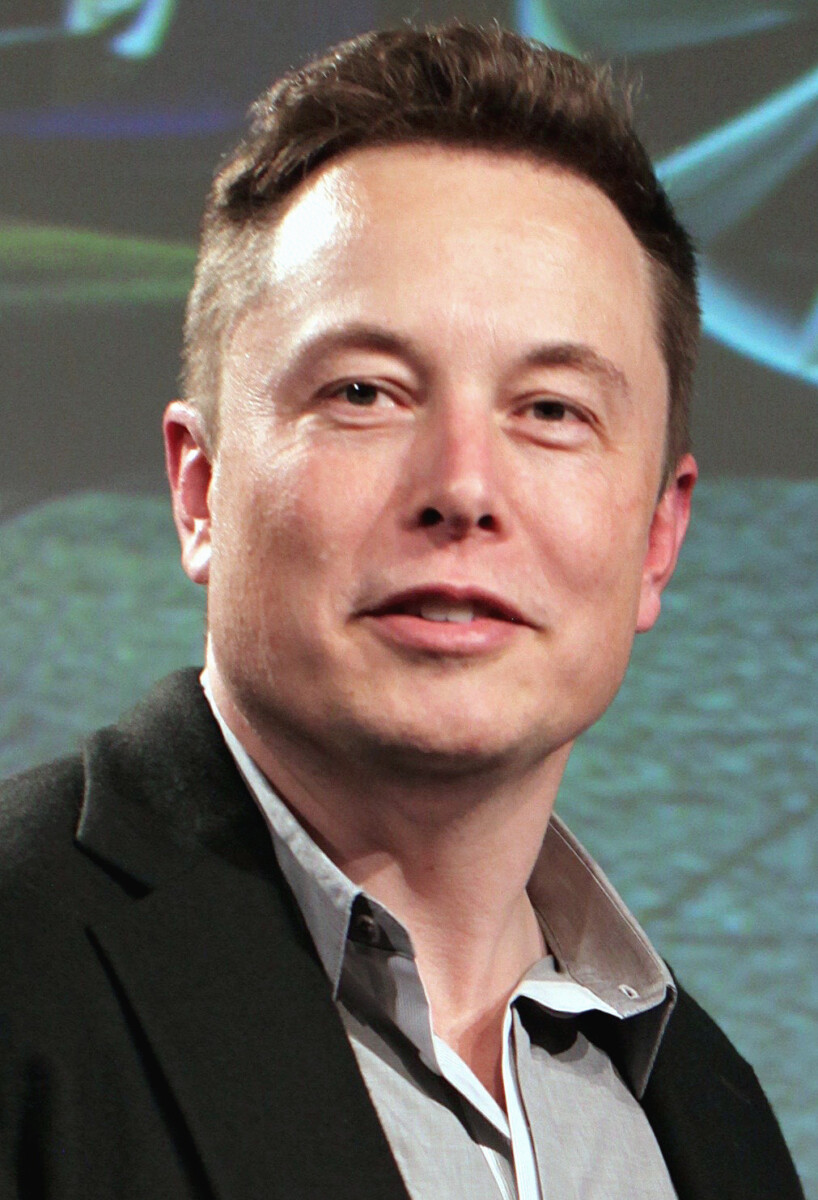

A Future of Unprecedented Abundance (Image Credits: Upload.wikimedia.org)

Elon Musk recently shared a provocative outlook on personal finance, suggesting that the rapid evolution of artificial intelligence might render traditional retirement planning unnecessary.

A Future of Unprecedented Abundance

Musk painted a picture of a world transformed by technology during his appearance on the Moonshots With Peter Diamandis podcast. He argued that AI would generate such vast surpluses in resources that scarcity becomes a thing of the past. In this scenario, individuals could access superior medical treatments, endless educational opportunities, and an array of goods without financial barriers.

The Tesla and SpaceX CEO emphasized that this shift could unfold within the next decade. He described a society where advanced healthcare rivals the best available today and extends to everyone. Musk highlighted how AI could unlock solar energy on a massive scale, powering an economy measured not in dollars but in energy output, or wattage. Such innovations, he claimed, would eliminate the need for hoarding wealth to secure one’s later years.

Challenging Conventional Wisdom on Savings

Musk’s core message challenged listeners to rethink long-term financial strategies. He advised against fixating on building nest eggs for retirement in 10 or 20 years, stating that such efforts would soon prove irrelevant. Instead, he urged focus on the present amid accelerating technological change.

This perspective stems from Musk’s belief in AI’s potential to create universal prosperity. He envisioned “universal high income” rather than mere basic support, where robots and algorithms handle production and services. Yet, he tempered his optimism by warning of transitional challenges, including potential social disruptions as economies adapt. Despite these hurdles, Musk remained confident that the end result would benefit humanity broadly.

Echoes of Historical Predictions

Musk’s ideas resonate with earlier forecasts about technology’s impact on work and wealth. Economist John Maynard Keynes, in a 1930 essay, predicted that by 2030, advancements would shrink the workweek to just 15 hours, freeing people from laborious toil. Keynes foresaw machines taking over mundane tasks, allowing more time for leisure and fulfillment.

History has partially validated these thoughts. The standard workweek dropped from around 50 hours in the early 20th century to about 40 hours soon after Keynes wrote. Today, full-time employees average roughly 42.5 hours weekly, according to U.S. Bureau of Labor Statistics data. While work hours have not plummeted as drastically as anticipated, technology has indeed revolutionized industries, from manufacturing to information access. Musk’s update builds on this foundation, projecting AI as the next catalyst for even greater shifts.

Navigating Today’s Economic Realities

Despite Musk’s forward-looking optimism, current financial pressures paint a stark contrast. Many Americans grapple with everyday costs, such as childcare, which often demands six-figure salaries for affordability. A 2025 National Council on Aging report revealed that 80 percent of adults over 60 lack sufficient assets to withstand a major financial setback, like illness or long-term care needs.

This vulnerability underscores widening inequalities, particularly among older populations. The report warned of deepening divides between the majority and the wealthiest 20 percent. For now, experts recommend maintaining diversified savings and emergency funds, even as disruptive technologies loom. Musk acknowledged these “bumps” on the path to abundance, suggesting preparation for volatility in the interim.

To illustrate key contrasts between Musk’s vision and present-day challenges:

- Abundance vs. Scarcity: AI promises limitless resources, yet 80 percent of seniors face poverty risks from shocks.

- Universal Access: Advanced care for all in five years, compared to current struggles with basic healthcare affordability.

- Work Transformation: Potential for high income without traditional labor, against today’s 42.5-hour average workweeks.

- Currency Shift: Measuring wealth in energy rather than money, while inflation and costs dominate headlines.

Key Takeaways

- AI could usher in an era of resource surplus, making savings less critical.

- Transitional unrest may accompany rapid changes, requiring adaptive strategies.

- Historical predictions like Keynes’ show technology’s mixed track record on work-life balance.

Musk’s forecast invites reflection on how AI might redefine prosperity, urging a balance between innovation’s promise and prudent planning today. As society edges toward this potential utopia, the journey demands resilience. What are your thoughts on preparing for an AI-driven economy – optimistic or cautious? Share in the comments below.