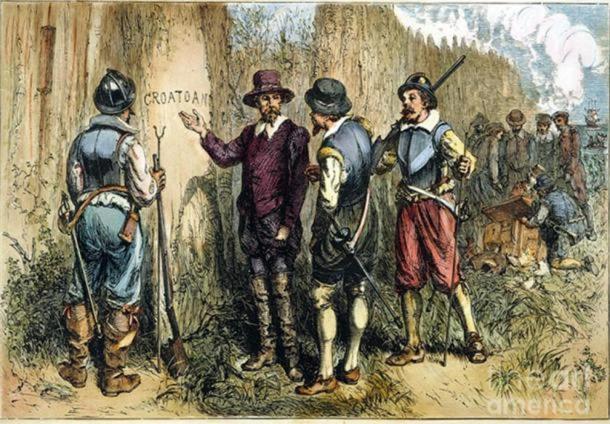

A Record-Breaking Buying Spree Kicks Off the Year (Image Credits: Unsplash)

In the shadowed halls of international finance, where decisions shape economies, gold’s steady shine offers a quiet promise of security against the chaos of modern markets.

A Record-Breaking Buying Spree Kicks Off the Year

Central banks snapped up 415 tons of gold in the first half of 2025 alone. That’s more than double the average from the previous decade. This frenzy isn’t random; it’s a calculated move in response to shifting global dynamics.

Experts point out that purchases have accelerated since geopolitical tensions flared up a few years back. Countries like China and India lead the charge, adding to reserves month after month. Such activity signals a deeper strategy at play, one that’s pushing gold prices toward new highs.

Diversifying Reserves Beyond the Dollar

Many central banks worry about over-reliance on the US dollar. With 73% of surveyed officials expecting its share in global reserves to drop over the next five years, gold steps in as a neutral alternative. It helps balance portfolios without tying fate to any single currency.

This shift makes sense when you consider recent trade wars and sanctions. Gold acts as a hedge, ensuring reserves hold value no matter what happens in forex markets. Banks in emerging economies, especially, see it as a way to build independence.

Hedging Against Inflation’s Persistent Grip

Inflation remains a headache for economies worldwide, even as rates fluctuate. Gold has long served as an inflation fighter, maintaining purchasing power when paper currencies falter. In 2025, with ongoing supply chain issues, this role feels more vital than ever.

Central bankers cite gold’s track record during high-inflation periods. It doesn’t erode like bonds might under rising prices. Instead, it climbs, offering a buffer that stabilizes national wealth.

Geopolitical Risks Fuel the Demand

From ongoing conflicts to tariff threats, the world feels unsteady. Gold thrives in such environments, often rallying when stocks and currencies wobble. Central banks recognize this, using it to safeguard against sudden shocks.

Take Russia’s strategy post-sanctions; it boosted gold holdings to sidestep frozen assets. Others follow suit, viewing gold as a geopolitical insurance policy. This trend shows no signs of slowing, with analysts forecasting even higher buys through year-end.

The Unique Appeal as a Store of Value

Gold isn’t just metal; it’s a timeless asset that doesn’t depend on any government’s promise. Central banks value its scarcity and durability, especially when trust in fiat money dips. In surveys, over 70% highlight its role as a reliable long-term hold.

Unlike volatile tech stocks or even cryptocurrencies, gold weathers storms. It pairs well with other reserves, reducing overall risk. This reliability draws in institutions managing trillions, making gold a cornerstone of modern strategies.

Looking Ahead: Projections for Continued Momentum

Forecasts suggest central banks could buy over 1,000 tons in 2025, potentially driving gold prices past $3,000 per ounce. Firms like Goldman Sachs and J.P. Morgan see this demand sustaining the bull run into 2026.

With interest rate cuts on the horizon, gold’s allure grows. It inversely ties to low-rate environments, attracting more official buyers. Yet, some wonder if prices might cool if economic stability returns – though most bets lean bullish.

Central banks’ gold obsession underscores a quest for resilience in uncertain times. As reserves evolve, gold remains the steady anchor. What sparks your interest in this trend? Share your thoughts in the comments below.

Key Takeaways

- Gold diversifies away from dollar dominance, expected to rise in reserve shares.

- It hedges inflation and geopolitical risks, proven in crises.

- 2025 buying could hit records, boosting prices toward $4,000 by mid-2026.